Business

Wema Bank Showcases Strong Q3 Performance

Wema Bank Plc has announced its unaudited results for the 3rd Quarter ended 30th September 2023., Showing an improved third quarter performance.

According to the unaudited results released, the bank continued its growth trajectory and momentum across all key performance indicators.

The commercial bank achieved an impressive Gross Earnings of ₦150.90bn, a y/y increase of 61% (Q3 2022: ₦93.86bn). Interest Income went up 61 percent y/y to ₦126.67bn (Q3 2022: ₦78.48bn).

Non-Interest Income also jumped up 58% y/y to ₦24.23bn (Q3 2022: ₦15.38bn).

The Profit before Tax (PBT) soared to ₦21.76bn a y/y increase of 130 percent over the ₦9.46n reported in Q3 2022.

Similarly, Profit after Tax (PAT) also increased y/y by 131 percent to ₦18.88bn (₦8.19bn in Q3 2022). The bank grew its deposit year to date by 42 percent to ₦1,650.75bn from ₦1,165.93bn reported in FY 2022.

Loans and Advances also grew by 27 percent to ₦661.30bn in Q3 2023 from ₦521.43bn in FY, 2022.

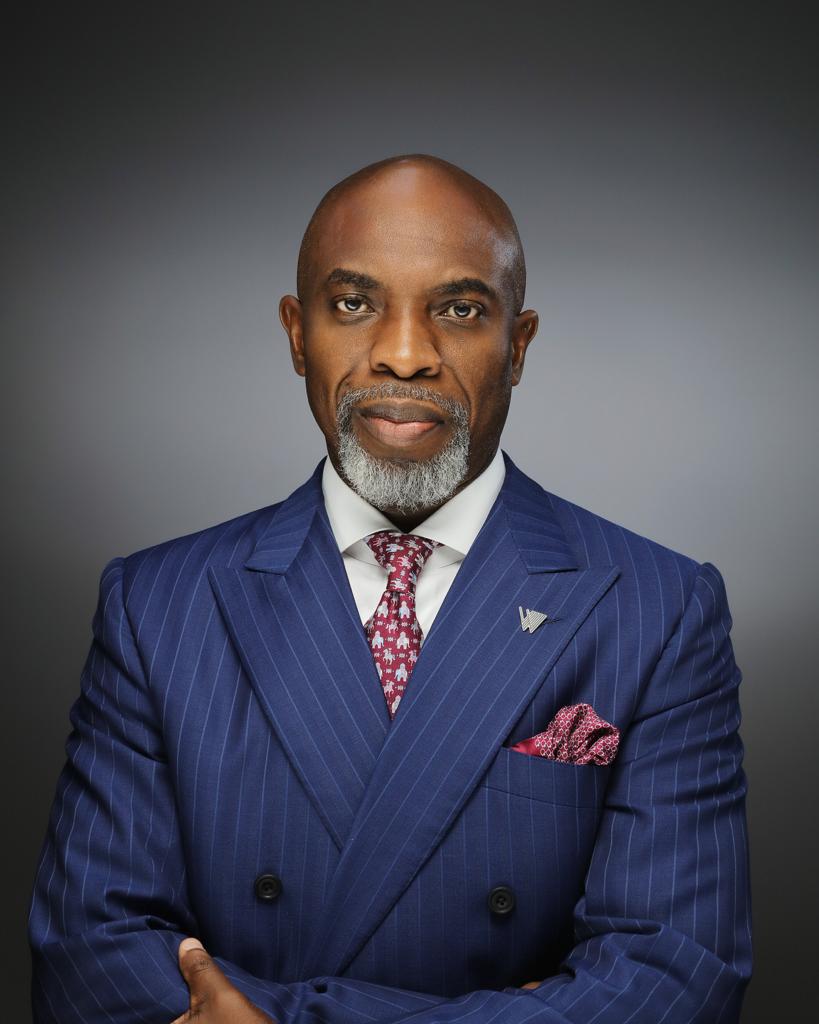

Commenting on the result, the Managing Director/Chief Executive Officer of the bank, Mr. Moruf Oseni, said,

“Our Q3 2023 results saw significant improvements with profit before and after tax growing strongly by about 130% & 131% respectively.

“It has been a good Q3 performance for Wema Bank with gross earnings growing by 61% year on year and earnings per share at 199.6 kobo. In addition, our cost to income ratio at 71.11% has witnessed significant improvement from the previous period.”